In the world of trucking, there is an undeniable cash flow crisis. This sector, vital to our global economy, often finds itself plagued with delayed payments, often exceeding 30 business days. This lag can stifle carriers, forcing them to struggle with immediate overhead costs – fuel, maintenance, insurance, and payroll – while waiting for due payments.

Meet Bob

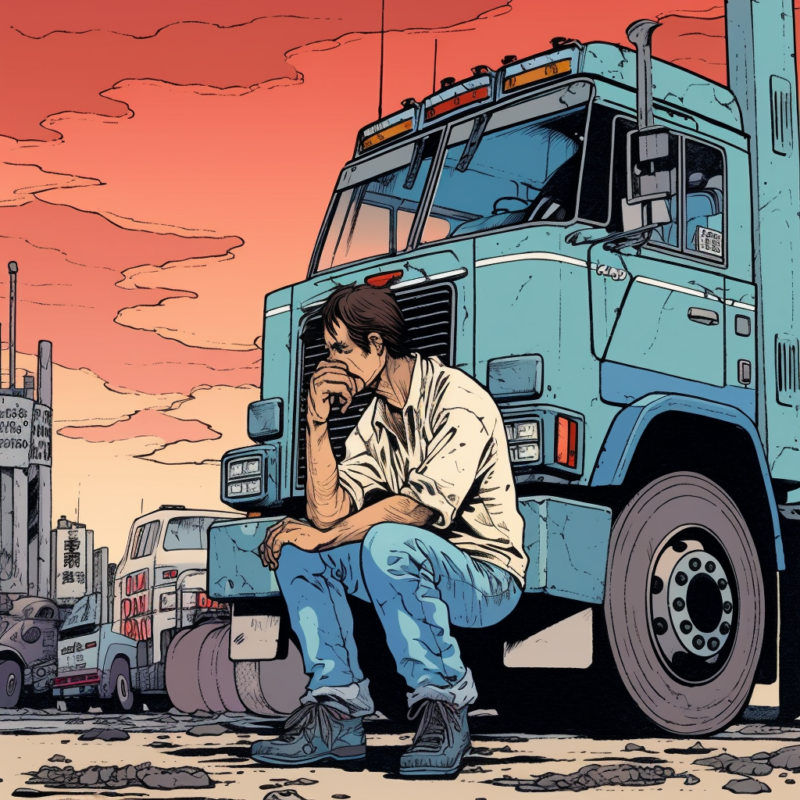

Meet Bob, an independent truck driver from Ohio who had a passion for the open road and the freedom that came with running his own small carrier business. Bob was his own boss, a role he relished, despite the occasional long nights and the demands of keeping his rig in top shape.

However, as time passed, Bob started feeling the pinch of one of the trucking industry’s most persistent problems – the delay in payments. Typically, he had to wait 30 business days to receive his dues. Though this was industry standard, it put significant strain on his finances, especially when unexpected costs arose.

One harsh winter, an expensive truck repair cropped up. Bob found himself in a financial tight spot, with outstanding bills piling up and no immediate payments due from his customers. Out of options, Bob resorted to maxing out his credit cards to cover the repair costs and keep his business running.

As the weeks passed, the strain of juggling the debt while continuing to operate began to take a toll. The payments from his customers eventually came through, but they were too late to stave off the snowballing interest on his credit card debt. Despite his best efforts, Bob’s financial situation continued to deteriorate until he was left with a heartbreaking decision – to shut down his business.

Bob’s story underlines the critical issue many owner-operators face in the trucking industry – the cash flow crunch from extended payment terms. It illuminates the pressing need to explore and implement innovative solutions like blockchain and cryptocurrency that can provide instant payments, helping to ensure the survival and growth of businesses like Bob’s.

Technology is the Solution For Trucking

What if there was a way to ensure instant payment upon completion of a task? An assurance that would not just benefit the carriers, but also the brokers and customers? This is where blockchain technology, coupled with the power of cryptocurrency and smart contracts, presents a revolutionary solution.

In this article, we explore how these emerging technologies could disrupt the trucking industry’s payment systems, offering instant cash flow solutions and paving the way for more secure and efficient transactions. Let’s delve into the mechanics of blockchain and smart contracts and see how they can be the game changer in solving the cash flow crisis in trucking.

The Cash Flow Dilemma in the Trucking Industry

The trucking industry is the lifeblood of global trade, but beneath the surface, it’s grappling with a cash flow crisis. The issue runs deep and is particularly acute for owner-operators and smaller carriers.

Let’s paint the picture: a carrier delivers the load, obtains a signed bill of lading (BOL), and then awaits payment from the broker or direct customer. It sounds straightforward, but there’s a snag. The standard payment terms often extend to 30 days, if not longer. This delay places carriers in a precarious financial position, as they must cover hefty operational costs – fuel, maintenance, insurance, payroll, among others – in the interim.

Such a conundrum is more than just an inconvenience; it’s a potential business killer. Smaller carriers and newcomers to the industry, lacking the financial buffer of their larger counterparts, are particularly vulnerable. To keep their wheels turning, they need stable, reliable cash flows. It’s a relentless challenge, and the traditional payment mechanisms in the trucking industry seem ill-equipped to address it.

Moreover, these prolonged payment cycles have a domino effect. Many carriers operate on tight margins, and delayed payments can lead to a financial strain that’s unsustainable. This, coupled with other industry challenges, can – and does – force carriers out of business. It’s a grim reality but a reality nonetheless.

But what if there was a way to ensure immediate fund release upon the signing of the BOL? Enter blockchain, cryptocurrency, and smart contracts – innovative technologies that hold the promise to revolutionize the financial framework of the trucking industry, offering a lifeline to the enduring cash flow conundrum.

Cryptocurrency and Blockchain: Beyond the Skepticism

To the uninitiated, the mention of ‘cryptocurrency’ and ‘blockchain’ might stir up hesitations – often due to the associated scams and the volatility of digital currencies. However, blockchain technology – the underlying foundation of all cryptocurrencies – has been under active research and development for years and has far-reaching applications beyond the sphere of digital currencies.

Blockchain, essentially a distributed ledger technology, holds great potential in mitigating some of the critical issues in the trucking industry. It offers a transparent, secure, and immutable platform, where every transaction is recorded and visible to all parties involved. This increases trust and fairness in business operations.

The unique strength of blockchain comes from its decentralized nature, which allows it to operate independently of any central authority. This reduces the chance of fraud and increases the efficiency of transactions.

Smart contracts, a key feature of blockchain, can automate transactions based on predetermined conditions. In the trucking industry context, a smart contract could be set to release payment automatically once a bill of lading (BOL) is signed. This technology could potentially revolutionize payment terms and cash flow issues in trucking, reducing wait times and ensuring all parties uphold their end of the agreement.

It’s important to note that embracing blockchain doesn’t necessarily mean engaging with volatile cryptocurrencies. Stablecoins, a type of digital currency pegged to stable assets like the US dollar, can provide the benefits of instantaneous, blockchain-enabled transactions without the financial risks associated with cryptocurrencies like Bitcoin or Ethereum. In this way, the trucking industry could leverage blockchain technology’s advantages while bypassing the volatility typically associated with digital currencies.

Blockchain technology, paired with the right understanding and implementation, could indeed bring a new era of transparency, efficiency, and financial stability to the trucking industry.

Implementing Blockchain in the Trucking Industry

Transitioning the trucking industry’s traditional payment methods to a blockchain-based system would indeed be a disruptive move, but it also holds the potential for significant benefits. However, this shift wouldn’t be without its challenges. To put this innovative system into practice, all parties involved would need to adopt and adapt to the technology, a process that could be met with resistance or skepticism.

As a primary challenge, adoption would require a consensus amongst carriers, brokers, and customers. As with any major shift in operations, there’s a learning curve associated with understanding, trusting, and using blockchain technology and cryptocurrency. It would necessitate industry-wide education and a common understanding of the benefits and mechanics of this technology.

Security, a concern often associated with digital transactions, would need to be rigorously addressed. However, the use of blockchain’s transparent and immutable ledger system inherently tackles this issue, as every transaction is recorded and traceable, reducing the possibility of fraud.

Another hurdle lies in the legal and regulatory sphere. The regulatory landscape around cryptocurrency is still evolving, and this could introduce an element of uncertainty. Yet, the introduction of a Central Bank Digital Currency (CBDC) could provide a regulated, stable medium for such transactions, perhaps even compelling businesses to transact digitally.

Addressing these challenges would demand a collaborative approach involving industry stakeholders, technologists, and policymakers. However, given the tangible benefits of improved cash flow and reduced administrative burden, the incentive for making this shift is clear.

In conclusion, while the implementation of blockchain in the trucking industry would undeniably involve disruption and adaptation, it also represents a significant opportunity. The prospect of instant payments could transform the industry’s cash flow landscape, providing a lifeline to many carriers and owner-operators currently struggling under the weight of extended payment terms. And with the continuous technological advances and increasing digitalization of industries worldwide, this innovative solution seems not just feasible, but a logical step forward.

The Future of Payments in the Trucking Industry

As we step into the future, the trucking industry’s payment infrastructure stands on the cusp of a transformative change. Driven by the evolution of technology and the necessity for efficient, transparent payment systems, the landscape of the industry is ripe for a revolution powered by blockchain, cryptocurrency, and smart contracts.

Imagine a future where a truck enters a geofenced area at the delivery point, triggering an automatic alert that the goods have been delivered. This alert, in turn, activates a smart contract written on a blockchain. The smart contract verifies the completion of the delivery against the immutable record on the blockchain and releases the payment in cryptocurrency instantaneously. No invoices, no paperwork, no lengthy payment terms – just swift, secure transactions, with all parties having full visibility and assurance of the process.

Furthermore, as Robotic Process Automation (RPA) and Artificial Intelligence (AI) become increasingly integrated into the logistics industry, we can anticipate even more efficiency gains. AI can analyze and predict delivery routes, making adjustments based on real-time conditions to ensure optimal efficiency, while RPA can automate administrative tasks, reducing overhead and freeing up resources. Together, these technologies can streamline operations like never before.

This vision is not just a pie in the sky. It’s a foreseeable reality that could resolve the long-standing cash flow issues that have burdened the trucking industry. It’s a future where technology serves as an enabler, fostering transparency, efficiency, and, above all, sustainability for carriers, brokers, and everyone involved in the logistics process.

It’s evident that the technology is available and the need is present. The challenge now is to bridge the gap, driving adoption and facilitating the transition. With companies like Ninja Dispatch already leading the charge in incorporating advanced technology solutions into logistics, the future of payments in the trucking industry is not just a prospect – it’s a journey already underway.